The way my travels fell meant I got back to back posts for sales tax because of the release schedule. So the question is: what have we learned? Well if somebody can explain to me the way the city is breaking out the report and why that makes sense, I would appreciate it.

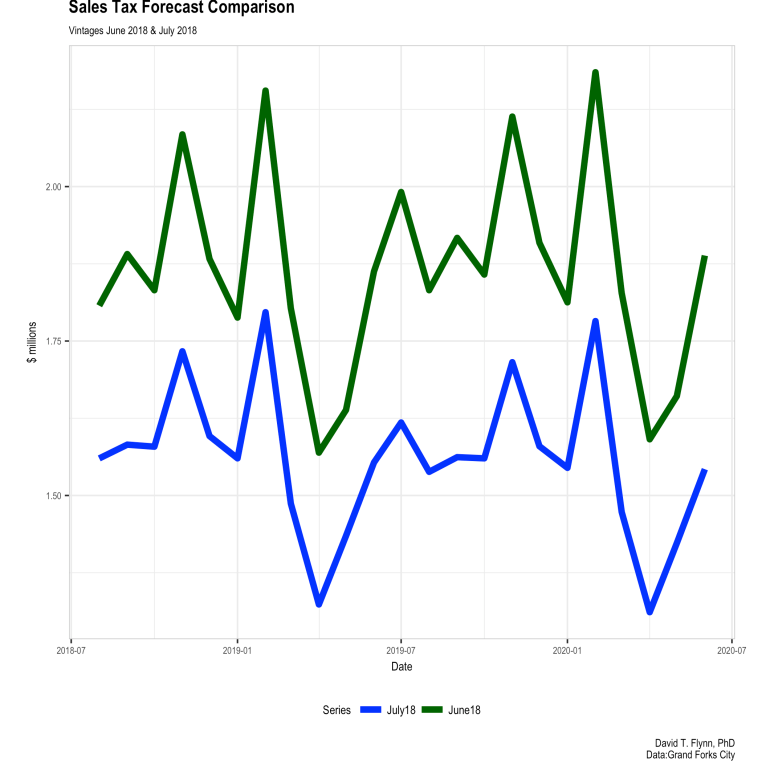

Collections were lower than the year before and again lower than the month before. The forecast now looks like:

The flattening of the outlook might actually be some good news. My general impression is that Grand Forks is still in a higher than normal volatility frame with many different changes mucking up the signals from the data. What do I mean?

We are still dealing with the changes at the university and how they impact the local economy, the overall economy of the state is adjusting to the start of a new oil cycle, summer is a curious time in college towns, a federal tax cut (temporary), a looming trade war, and the list goes on. While any one of these could be problematic for a forecast they are likely ways to control for it better than when you have all these events occurring at the same time. But hey, that is the life of the prognosticator so moving on to the outlook.

The outlook drops back down from the month prior unfortunately, though still predicts some back to school and holiday sales bumps. I am going to be playing with the parameters a bunch in the next few weeks to see if I cannot introduce some stability into the predictions or at least better understand the pattern behind some of the changes.

What this speaks to overall right now is a local economy in a state of flux and that planning is crucial right now in terms of budgets. With the state suggesting more cutting in the next biennium for certain parts of the state budget competitions for dollars is going to be more intense, at least potentially. The city needs to get to a better understanding of the local dynamics now, and better relate those to the state as a whole and other subregions.