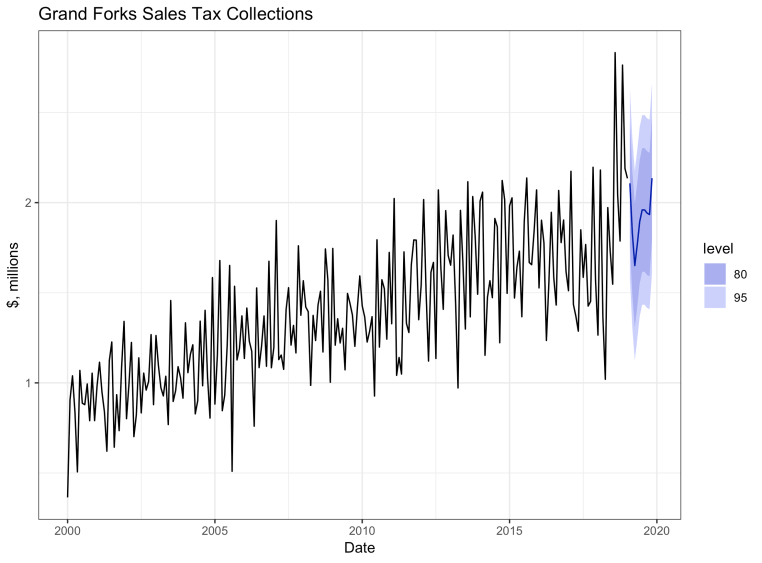

I thought I would update the sales tax forecast today. Teaching forecasting means a great deal of my time is spent looking at these types of models. There is an enormous amount of volatility in the Grand Forks sales tax collection data. I have started work on some related models to try and smooth out some of the volatility and maybe make the statistical properties of the series a bit more tractable. It really cannot help any type of planning exercise to see such enormous volatility in the year-over-year percentage change in collections.

The recent changes to the tax rate notwithstanding it is pretty clear that a few of the recent months were the reason that tax collections managed a small gain at the end of the fiscal cycle. The confidence bands are quite wide right now and hopefully some adjustments will narrow them over time.

The good news in the forecast is that there should be some mild to moderate improvement in the collections. We should move from 5% year-over-year gains to approximately 7% year-over-year gains over the course of the next 24 months. There are many more complications and wrinkles to deal with in the next few months for this data but I expect significant model improvements.

When you look at the level for collections it seems to indicate drop in the near term, followed by a return to a higher threshold in the not too distant future. The statistical issues with this level series are part of the reason for such a wide confidence interval, though again, I am working to correct that.

From a planning perspective it would seem that there is a real need to get a better hold on the economic and fiscal trajectory for the region. There is significant volatility, and this type of volatility can create its own problems in terms of the compounding planning difficulties by deterring other economic activity.