We will get this out of the way at the start: inflation concerns are, at this point, jumping the gun. As discussed on the radio these last several weeks there are multiple components to inflation. There is a pent-up demand component as we came out of lockdowns and COVID related closures, there are supply chain issues raising prices right now, and there are labor shortage issues. All contribute to inflation, to varying degrees depending on the region and the types of goods and services. The addition of a large stimulus can be expected to put further upward pressure on prices. Very little of this is unexpected and while inflation contains seeds of social ills there is likely market response coming to this as well in the form of higher wages and more.

Inflation has been lower than expectations for a very long period of time. During the lower consumer prices we saw asset price inflation (stock market and housing) going full speed ahead. It is perhaps important to consider all forms of price increases in concert. At the same time, the mix of goods purchased is not always the same as the reported aggregates. I isolate a longer view of inflation in three categories.

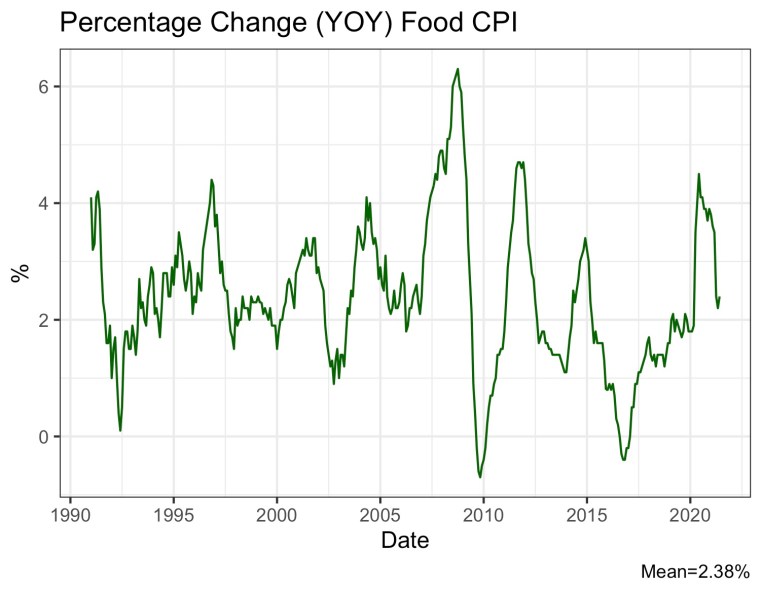

You can see that food price inflation averaged around 2.4% over the last 30 years, and that it has been quite volatile. The COVID spike in food inflation was real and has since come down some, perhaps returning to a pre-COVID trend.

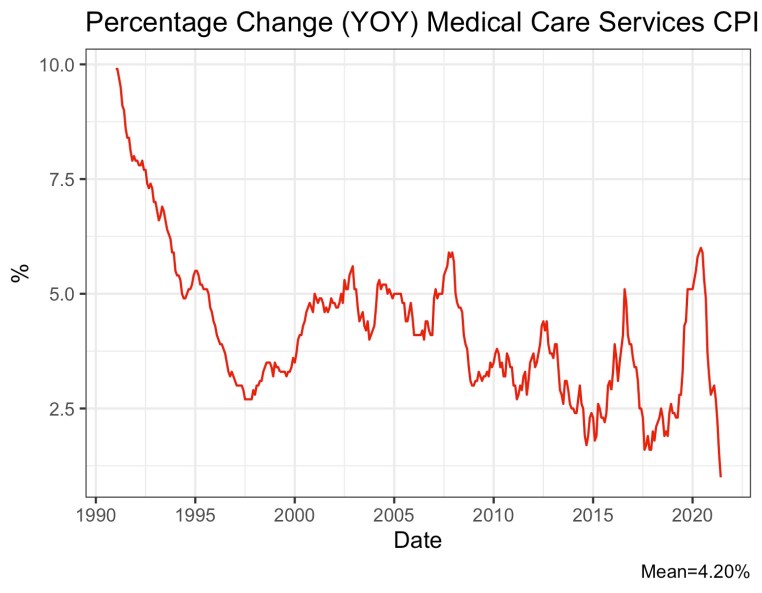

Medical care is another big concern for people and the service category includes insurance, hospital services, and more. Of note is the decline over the last thirty years but it is interesting to note that it seems to stabilize between 2.5% and 5% in this century and never goes negative. The decline in inflation now is worth studying and could be due to reduced demand related to restricted access from COVID, telehealth, or other factors.

Energy gets a significant amount of attention. Part of this is obviously due to the importance of the energy. I also think the volatility increases attention frankly. The energy price swings are large and to the positive and the negative.

With these three categories I try to point out the distinct patterns and experiences for them. Inflation is not uniform, in different goods and services, or in different regions.

There is a frequent caller to the radio show that mentions the minimum wage. In July of 2009 the wage increased to $7.25. The caller frequently mentions the loss of purchasing power this experienced over time. We can leave the debate about the purpose or intent of the minimum wage to another post. I figured the caller would be interested in knowing the equivalent hourly wage would be $9.15. A person working 2,080 hours per year would be short around $4,000 earnings on the year without the adjustment for inflation.